Time management, problem solving and project management have emerged as skills which are most in demand throughout Australia’s construction sector, the latest study has found.

In the 2020 edition of its How We Build Now report based on phone and email interviews of 260 small, medium and large construction contractors conducted by AC Research, construction project management software company Procore looked at skills which are in greatest demand.

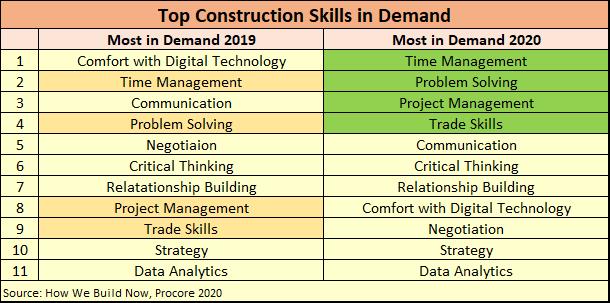

It found that time management, problem solving and project management skills are most in demand followed by trade skills and communication skills (see chart).

The top three skills have moved up from second, fourth and seventh in the same survey last year.

Meanwhile, trade skills jumped from eighth last year to fourth in 2020.

These skills have displaced others such as comfort with digital technology, which has fallen from first place last year to seventh in the most recent survey.

In other survey results, across the respondents:

- 49 percent agree that builders will need to broaden their skill sets going forward – down from 51 percent who said likewise in last year’s survey.

- 56 percent are not ‘very confident’ that their current workforce had the skills needed for work across this year whilst 64 percent say that finding staff with the necessary skills will not be easy.

- Only 31 percent believe their current workforce will help them grow.

- 51 percent agree that women will form a crucial part of the construction workforce over the next ten years whilst 41 percent have a diversity policy in place.

Ben Selwyn, Director of AC Research, says the report highlights several themes.

First, the focus on time management, project management and problem solving reflects a desire from contractors to be as productive as possible.

Behind that, the shift toward trade skills as opposed to technology skills reflects more conservative behaviour from smaller builders who feel a need to refocus on what they are doing at the moment as opposed to driving innovation.

On a related note, Selwyn says the overall stability in the proportion of builders who feel that broader skill sets are necessary masks a shift as smaller builders pulled back in this area but larger to medium sized businesses have grown keener on more diverse skills.

Compared with the 2019 survey, the number of small businesses who agree that builders will need a broader skill set dropped by 14 percent from 61 percent in 2019 to 47 percent in the survey just passed.

Over that time, the proportion of medium and large businesses who feel likewise increased by 13 percent from 44 percent to 57 percent and by three percent from 41 percent to 44 percent.

“Our smaller builders are feeling very conservative,” he said.

“They are saying ‘you know what, we don’t need a broader skill set, we need to do what we do well. We are going to keep doing that,” Selwyn said.

“Our medium builders – and our large builders to a lesser extent – are looking at this in a more innovative way and saying, ‘We are looking at diversifying. We are looking at the new technologies and how we can use them to improve our profitability.

“’We are looking at how we can use them (technologies) to upskill our staff to improve productivity. How are we going to get these outcomes and improve our business overall?’”

The survey also looked at industry sentiment and approaches toward technology adoption – each of which is covered in earlier articles.

It found that COVID-19 had impacted builder confidence whilst builders are looking at a range of technologies to improve productivity and profitability.

Source: Andrew Heaton