Key points

Ensuring necessary and appropriate levels of social housing investment begins with a well-evidenced understanding of the scale, type and location of need and secondly, an accurate understanding of the cost of procuring appropriate dwellings in the right locations. The design of an investment pathway, and the use of public or private equity and debt, also significantly influences the cost to government and the wider community.

Our research builds a customised method for establishing both current unmet need (the backlog) for social housing and future projected need, based on a proportionate share of expected future household growth. It also provides evidence for the diverse geography of land and construction costs based on industry and project level data.

Five alternative pathways involving a range of debt, efficient financing and capital grant strategies have been modelled to assess their relative costs to government. The research shows the ‘capital grant’ model, supplemented by efficient financing, provides the most cost effective pathway for Australia—in preference to the ‘no capital grant, commercial financing operating subsidy’ model.

Over the next 20 years, it has been estimated that 727,300 additional social dwellings will be required, with current price procurement costs varying from $146,000 to $614,000, depending on local land values, building types and construction costs in different regions. This report provides extensive data on needs and costs for 88 statistical areas (SA4 level).

Where rents are set at levels affordable to low-income households, revenues can only support modest levels of debt financing and thus co-investment is also required.

International experience on infrastructure investment pathways cautions that, while ‘off balance sheet’ Public Private Partnerships and Private Finance Initiatives (PPP/PFI) have been widely utilised in comparable countries (as well as in Australia), these have often proven sub-optimal in terms of cost efficiency and effectiveness (UK National Audit Office, 2018).

This report provides inspiration from more productive, supply-orientated social housing systems that flourish in countries such as Scotland, Finland, France and Austria and most prominently amongst our Asian neighbours, China, Korea and Singapore.

Key findings

Key finding 1: Social housing requires an ‘infrastructure investment pathway’

Social housing shares similarities with many other forms of social infrastructure serving societal (as well as economic) needs (PC 2009:3). Schools, courts, prisons and hospitals are also long term asset-based services enhancing social and economic wellbeing which are allocated on a needs basis, rather than for commercial return. Investment in social infrastructure enables essential services to be delivered, schools enable education, hospitals enable health care and social housing enables secure affordable shelter, ideally to a decent standard, in the right location and when needed.

While users of infrastructure are increasingly called on to pay for associated services through various charges, full payment can undermine the social and economic benefits they are intended to deliver. For this reason, services such as health and education are not delivered on a full fee paying basis or driven to generate surpluses or recover costs. These services are intentionally subsidised to maximise the social and economic benefits they are designed to deliver.

An ‘infrastructure investment pathway’ is the route capital takes to construct and operate assets and services to deliver social and economic benefits to society. Both funding and financing play an integral role in this pathway. ‘Funding’ describes the resources allocated by governments and the community to cover capital investment and operating costs. ’Financing’ describes the instruments or arrangements which allows these costs, especially high up front capital costs, to be spread over time as government surpluses and service charges allow. Seen in this light— financing ultimately requires funding and is not a replacement for it. Social housing investment is no different—it requires the funding of an investment pathway which supplies and maintains capital assets and services over time.

Key finding 2: Greater capacity in needs-based planning, securing and allocating adequate funds and designing and implementing programs is required

Australia’s limited social housing is tightly targeted and its market share is declining. A range of investment pathways have been pursued in recent years, including contracting out services, off balance sheet debt via Community Housing Organisations (CHOs), re-investment via densification, asset sales and internal cross-subsidisation. These strategies have extracted value from the public estate and have not generated sufficient social housing units to address Australia’s growing need. Moving forward, a more sustainable pathway is required in order to grow and improve social housing stock. Australia can learn from national and international experience of more productive value building approaches.

International organisations increasingly call for more effective public investment and efficient financing of infrastructure, stressing greater capacity in needs-based planning, securing and allocating adequate funds and designing and implementing programs (IMF 2015). Mission focused public investment not only addresses market failure but also creates value (rather than extracts it) can stimulate innovation and promote inclusive growth (Mazzucato 2018).

First and foremost, in order to maximise social and economic outcomes, social housing requires a capital investment strategy informed by current and future needs. This research provides a simple methodology estimating needs over time. Secondly, productive social housing systems know what it takes to procure housing. Again this research provides up-to-date data on land and construction costs across Australia. Productive social housing systems use a range of instruments to ensure supply outcomes, necessarily including the investment of public equity and not-for-profit delivery. Demand side subsidies alone cannot increase supply and are particularly ineffective where provision is for profit, rents are deregulated and vacancies are low. Thirdly, productive social housing systems use efficient financing, as this reduces pressure on service charges and related assistance and ultimately reduces the cost burden on all taxpayers. Greater transparency in comparing the cost of capital is vital to help policy makers and program designers determine the ideal mix of funding and financing that should be used to address Australia’s social housing deficit. This research provides a customised framework to assess alternative financing options.

Key finding 3: The scale of need is significant but varies spatially; procurement costs also vary across different land and housing markets

To calculate the government capital investment required to meet the need for social housing, it is necessary to estimate (i) the scale of unmet need, (ii) the total cost of providing the homes required to meet that need (bearing in mind its spatial distribution), and (iii) the proportion of that cost in excess of what housing providers should be able to finance through debt.

In addressing point (i), above, we build on previously published methodologies to estimate the need for social housing over the next 20 years, to accommodate both current unmet need (the backlog) and future projected need, based on a proportionate share of expected future household growth. Taken into account here are three components:

- Existing social renters

- Those constituting ‘manifest (additional) need’ (i.e. homeless populations) and

- Those constituting ‘evident (additional) need’ (i.e. those with housing needs unmet by the market, but outside the above groups), both current and projected.

The third group is defined as households on a low income (bottom quintile for the relevant household type) and in rental stress (in private rental and paying more than 30% of income on rent).

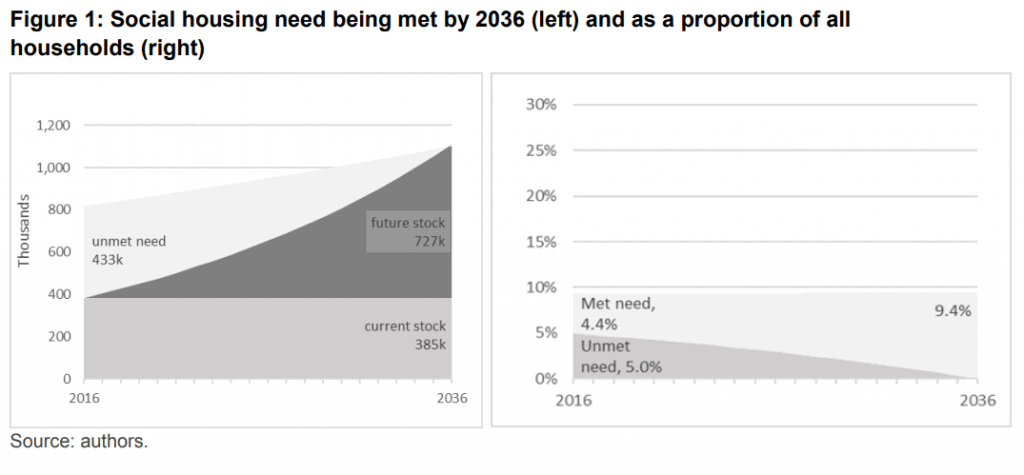

As summarised in Table 1, addressing the deficit and future need will call for the construction of some 730,000 new social dwellings over the next 20 years. This equates to an annual average growth of 5.5 per cent over the existing stock. Figure 1 below shows how this additional growth accounts for both current unmet need (the backlog) and future projected need, based on a proportionate share of future household growth.

Table 2 below shows the range of total procurement costs for the regions within each part of the states and territories, which includes the estimated land and construction costs, along with some estimated professional fees (legal and design services), and local impact fees/infrastructure contributions.

Affordable rents can only cover part of the cost of procuring, managing and maintaining this body of housing. In other words, after accounting for operational costs, rent revenue will be sufficient to provide only a proportion of the funds required to meet construction and land costs. Subsidy is required to fill the remaining gap.

Key finding 4: Modelling of investment scenarios demonstrates that capital grants, combined with efficient financing, is the most cost effective pathway for government

The varying cost to government of addressing the funding gap is examined in more detail via the comparison of different funding and financing strategies.

Building on the Affordable Housing Assessment Tool (AHAT) developed for the AHURI Inquiry into increasing supply of affordable housing (Randolf, Troy et al. 2018), project level costings of community housing provider (CHP)-led development from across Australia have been used to test the impacts of different funding and financing scenarios.

This modelling builds on the AHAT by integrating spatially differentiated need, land and construction costs, based on assessment of local need profiles at the sub-regional level (using Australian Bureau of Statistics (ABS) ‘SA4’ geography) developed in this research. It also details operating cost assumptions, such as not-for-profit provision and relevant tax settings. Each investment pathway aims to be cost-neutral after 20 years. Five pathways have been modelled to enable a comparison of their costs to government as outlined in Table 3 below:

As illustrated by the table below, debt-financed models significantly increase a housing provider’s requirement for an operating subsidy. The costs to governments are substantially reduced when public equity in the form of a capital grant is included in the investment mix and debt raised in the most efficient manner, as summarised in Table 4 below.

Our evaluation has provided a quantitative assessment of the cost to government of alternative funding and financing pathways based on comprehensive evidence of need and actual procurement costs. Financial modelling has employed the latest available data on geographically differentiated needs, as well as relevant land and construction costs for locally appropriate housing forms. It provides a substantial advancement on current methods and practice as well as vital evidence to inform Australia’s future funding and financing pathways.

Comparative modelling of funding and financing scenarios reveals that the capital grant model is substantially more cost-effective for governments than privately financed operating subsidy models. Operating subsidy models underpinned by debt finance introduce a layer of cost that is ultimately paid for by government, either through increased operating subsidy or increased tenant incomes, such as Commonwealth Rent Assistance (CRA) or other social security payments.

The more direct pathway of capital grants and efficient NHFIC financing has greater capacity than operating subsidies to ensure the supply and quality of housing outcomes delivered. Conditional investment can be made from a range of sources—general government revenue, public investment, contributions from public land banks and planning contributions—to ensure secure, affordable social housing outcomes commensurate with Australian needs.

The way forward for Australian government, regulated providers and the NHFIC

The Productivity Commission (2014: 2) stresses the urgent need to reform the way governments invest in Australian infrastructure, calling for better decision making, funding and financing choices. This imperative also applies to social housing, where current investment strategies are still failing to address contemporary and future needs.

Like other countries with supply orientated social housing systems, Australia can take a more productive and cost effective approach. Public debate remains firmly fixed on housing affordability and access concerns, and there is strong momentum from the affordable housing industry to establish a more effective pathway forward.

Building on the strengths of government, regulated providers and investors in the newly established Affordable Housing Bond Aggregator, more direct and ambitious funding strategies can ensure social housing needs are addressed. This research provides useful tools and evidence to guide policy makers towards this goal.

The establishment of the NHFIC in 2018 has provided Australia with a new affordable housing investment pathway, but further steps are required than more efficient finance to deliver social housing outcomes (AHWG 2017). Complementary and conditional funding is also required in order to ensure an ongoing pipeline of developments in which social housing plays an integral part.

Extensive consultation has taken place concerning the investment mandate of the bond aggregator within NHFIC, with legislation passed in July 2018. Challenging inter-governmental discussions concerning accountability for funding have concluded with the new NHHA, building stronger commitment to strategic housing plans via bilateral funding agreements. An official National Regulatory System for Community Housing Review is completing its work, following the recommendation to the Heads of Treasury by the Affordable Housing Working Group (AHWG 2017). There is also widespread recognition that the social housing funding gap needs to be filled to ensure an ongoing pipeline of investment.

This research explores how this funding gap should be addressed.

As shown by the financial modelling, combining capital grants with the most efficient form of NHFIC finance is the most cost effective pathway for government to pursue. It not only produces tangible accommodation assets but also reduces ongoing requirements for an operating subsidy. Such a pathway draws on international social housing experience and complements emerging policy developments in Australia and will ensure that the newly established bond aggregator (AHBA/NHFIC) can provide a pipeline of investments addressing the well-evidenced need for social housing infrastructure.

The study

This original and ground breaking research addresses the question: What is the most effective investment pathway to deliver required housing outcomes? It is informed by international practice, a customised and comprehensive assessment of social housing need, and financial modelling, factoring in this need as well as differing land and construction costs. The research complements and builds on two other research projects, which together inform the Inquiry into Social Housing as Infrastructure (Lawson, Flanagan et al. forthcoming) on the policy rationale (Flanagan, Martin et al. 2018) and infrastructure appraisal processes (Dodson and Denham, forthcoming) affecting social housing investment.

This research commenced in 2017 with literature reviews, interviews, demographic and financial modelling undertaken between May 2017 and July 2018. The findings were derived from the following methods:

- Stage 1 involved a review of national and international literature on pathways in infrastructure investment and methods for estimating needs, costs and the level of investment required. Interviews with 20 key international and national stakeholders and two half day industry workshops were conducted with the Clean Energy Finance Corporation and NSW Federation of Housing Associations CFO group, which validated our review and elaborated on our understanding of contemporary investment practice.

- Stage 2 involved the development of a simple demographic model to assess the level and distribution of social housing need across Australia. This takes into account not only existing social housing provision, but also the current backlog of unaddressed need, and the needs likely to arise over the next 20 years. Building on this assessment, the research analysed the cost of procuring housing in 88 different housing and land markets using appropriate housing forms.

- Stage 3 developed a customised Multi-Criteria Framework to evaluate the effectiveness, equity and efficiency of alternative funding and financing pathways. Specialised modelling, using UNSW’s Affordable Housing Assessment Tool, assessed the cost to government of five different funding and financing scenarios. Together this demonstrated the most effective investment pathway to meet Australian needs: capital investment and cost effective financing.